ट्रेडिंग में पहला कदम

ट्रेडिंग में पहला कदम

अपनी ट्रेडिंग में जोख़िम प्रबंधन को लागू करके आप किस प्रकार नुकसानों को कम कर सकते हैं

Welcome to the eighth lesson of our Forex Basic course.

In this lesson you’ll learn:

-

If it is possible to trade successfully without managing your risks.

-

What a series of drawdowns and a floating drawdown are.

-

What the problem is with replenishing your equity.

-

Three basic rules of risk management that will help you make a profit on Forex.

Can you make money on Forex without risk management?

Only 15% of Forex traders manage their risks. However, ignoring risk management makes the whole process a Forex gamble instead of Forex trading.

-

10% of all traders earn money steadily in Forex, while 90% of traders eventually lose all their investments.

-

The traders who make steady income in Forex are all among the 15% of traders who apply risk management.

Conclusion:Risk management does not guarantee you a success in Forex, but without risk management, you will lose your investment for sure. Let’s take a closer look at how this happens.

Series of drawdowns

Drawdown is a decrease of the equity in your trading account caused by a losing order.

Without managing risks, a trader usually loses the majority of their investment after a series of drawdowns. However, a series of drawdowns is quite common in the Forex market. Even if you use a highly effective strategy that has an 80% success rate, at some point you can run into a series of losing trades.

You’ll be able to preserve a significant part of your investment even after a series of drawdowns if you are prepared for it. That’s where you need risk management.

Drawdown may be fixed or floating.

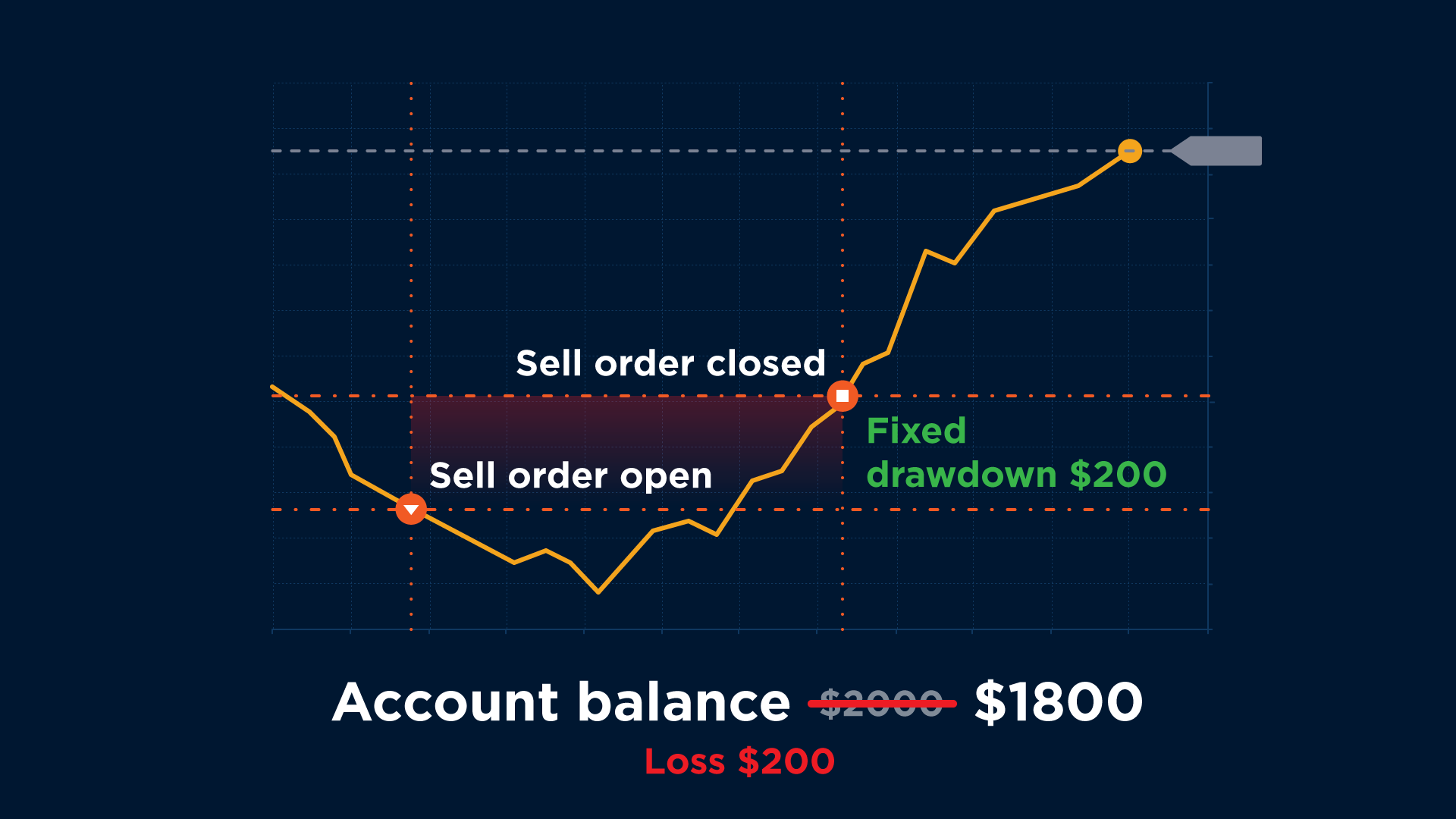

Fixed drawdown is a loss on an order that you’ve already closed.

-

You have fixed your losses, and their amount stops increasing.

-

Your account balance has decreased by the drawdown amount.

Floating drawdown is a loss on an order that is still open.

-

If the market persists against your prediction, your losses continue to grow.

-

Your account balance remains unchanged as the order is still open.

Floating drawdown is the most dangerous one because many traders continue to estimate the success of their trading activity by their balance amount and ignore their equity.

An issue of replenishing your equity

The most important issue with a series of drawdowns is that the more you lose, the harder it is to make it back to your original account volume. That the percent of the equity you need to return to recover your balance grows drastically.

Risk management

Three basic rules of risk management:

-

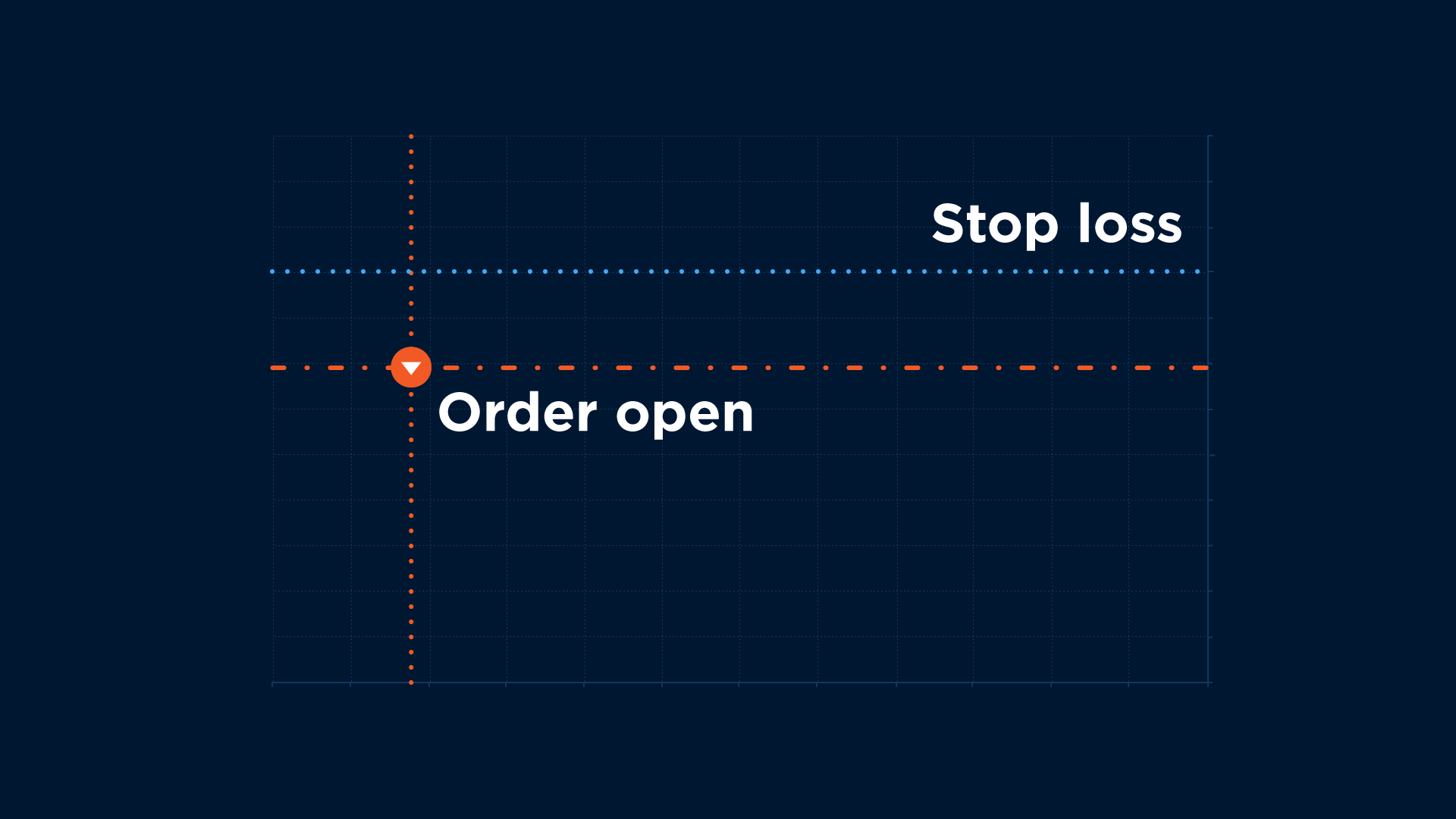

Set a Stop Loss level for each order to limit your floating drawdown.

-

Open orders only when your potential income is three times larger than your possible loss.

-

Set the tolerable losses of your orders at 2% of your equity or lower (a Two-Percent Rule).

Limiting your floating drawdown

Whenever you open an order, always set Stop Loss. In this case, the drawdown of your order will never exceed the level that you preset.

It is often not that easy to convince yourself to close a losing order. MetaTrader’s Stop Loss will make that decision for you.

Important! Do not adjust the Stop Loss level of an order you’ve already opened! This would mean you deviate from your strategy in the emotion of the moment.

You now set your maximum tolerable losses for all your orders. But how can you determine their level? To calculate it, apply the rule Stop Loss = ⅓ Take Profit.

Stop Loss = ⅓ Take Profit

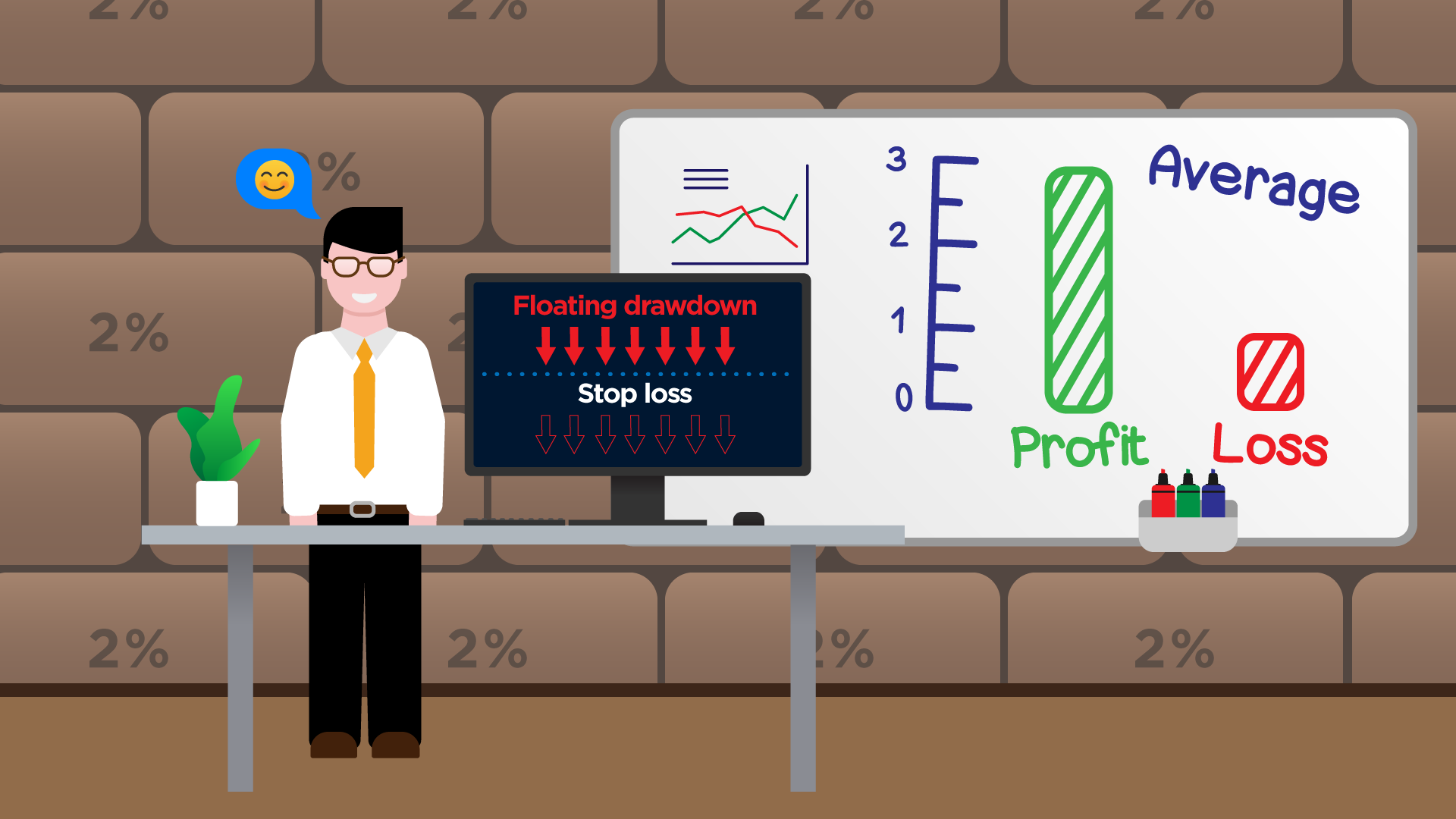

Remember the formula for profit that we introduced in the lesson ‘How to avoid paying extra to a broker’. We’ll now take a closer look at its core section. You can increase your profit by either increasing the percentage of your profitable orders or managing your average profit and average loss.

Increasing the percentage of your profitable orders

It is not as simple as one might think. 80% of traders make less than a half of their trades profitable. Yet this is enough to gain when trading Forex. Your trading strategy is actually successful even if slightly more than 50% of the orders you open are profitable. Surviving through certain events on the Forex market with a success rate that is slightly below 50% may also be acceptable.

Managing your average profit and loss

To increase your average profit and decrease your average loss, apply the rule: Stop Loss = ⅓ Take Profit.

Calculate your potential profit before opening an order. Set your Take Profit at this price level. Your maximum tolerable loss should not exceed ⅓ of your potential profit. Set Stop Loss at the corresponding price level. If your strategy does not allow you to set Stop Loss at that level, do not open the order.

Two-Percent Rule

Maximum allowable losses on your new order may not exceed 2% of your current equity. If you can see that the maximum level of losses on the order you are about to open may amount more than 2% of your equity, you need to decrease this order’s volume (lower the number of lots).

The Two-Percent Rule allows you to preserve the major part of your investment and keep to your strategy even after a series of drawdowns.

How Two-Percent Rule works:

Let’s suppose that you have $2,000 in your trading account.

If you make 5 losing orders in a row, you’ll have $1,807 in your account.

If your losing streak grows to 10 orders, you’ll have $1,634 in your account.

After 20 losing orders, you will have $1,335 remaining.

After 30 losing orders, you will still have $1,090 in your account balance—55% of your initial investment.

If you violate the Two-Percent Rule and risk 10% of your equity for every order, you will face the following:

After a series of just 5 losing orders, you will have $1,181 remaining in your account.

After 10 losing orders, you will have your balance decreased to $697.

After 20 losing orders, you will only have $243 in your account.

In the end, 30 losing orders will reduce your investment almost to zero.

Let’s repeat what we’ve learnt in this lesson:

-

You won’t succeed in trading without risk management.

-

You may face multiple drawdowns with any strategy. They sometimes may last for quite a long time. You need to learn how to overcome them when you trade.

-

You may face multiple drawdowns with any strategy. They sometimes may last for quite a long time. You need to learn how to overcome them when you trade.

-

Apply the Two-Percent Rule every time you open an order: the maximum amount of loss on the order should not exceed 2% of your trading account equity.

-

Open an order only if your potential profit is three times your possible loss. Stop Loss = ⅓ Take Profit.