ट्रेडिंग में पहला कदम

ट्रेडिंग में पहला कदम

अपूर्ण ऑर्डर्स, स्टॉप लॉस और टेक प्रॉफिट किस प्रकार आपका समय बचाते हैं

In this lesson you will learn:

-

What the difference is between orders opened by market price and pending orders.

-

How Stop Loss and Take Profit work.

-

How to place pending buy and sell orders.

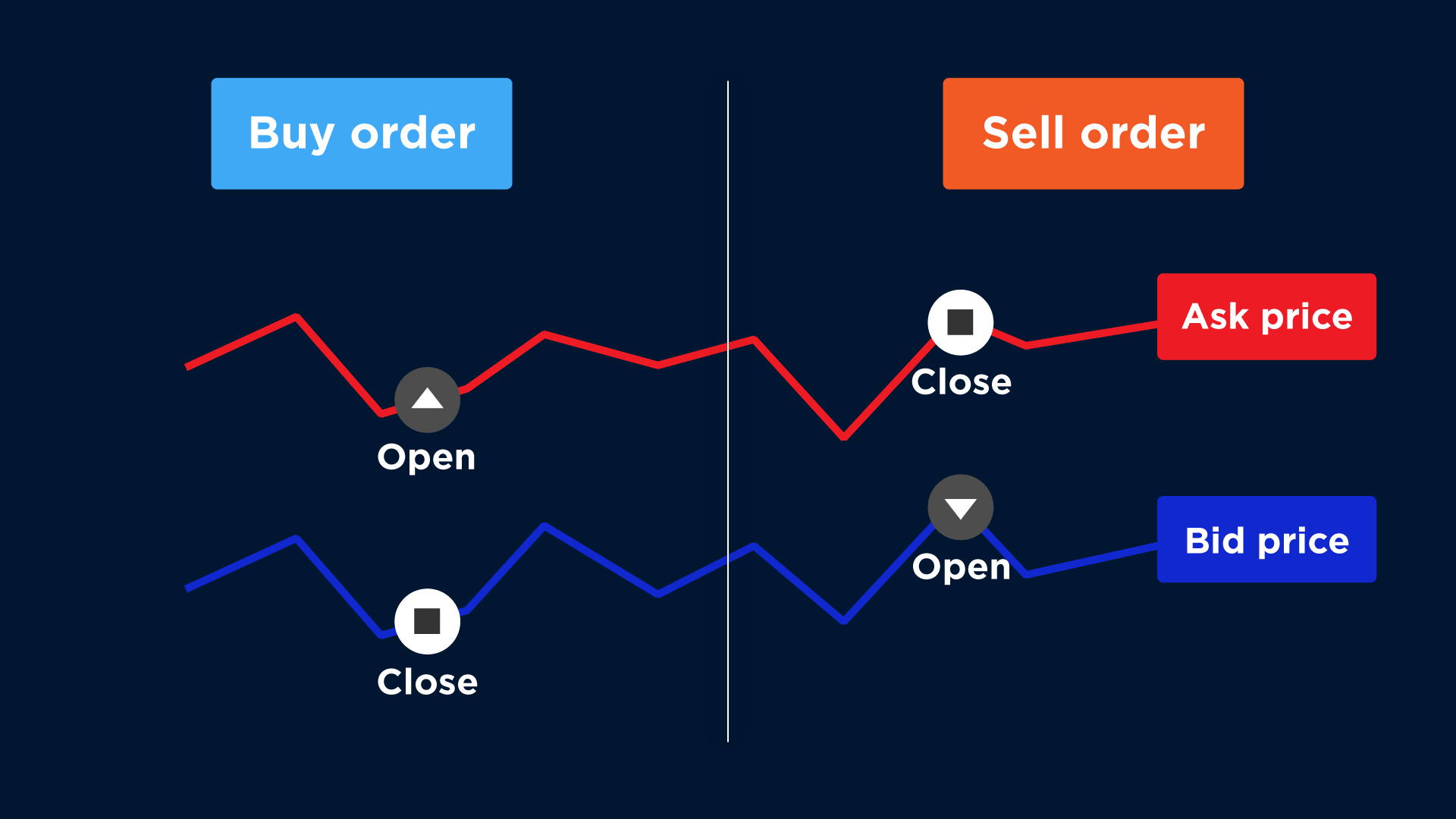

Orders opened and closed by market price

The ability to work with pending orders will save you dozens of hours every day. You can go about your business and benefit from market movements that you have pre-calculated.

In the previous lesson, you learnt how to open and close orders in MetaTrader 4. At that stage, you opened and closed your orders by market price. Opening and closing an order by market price means executing it at current Ask and Bid prices.

Whenever you open and close your orders by market price, you need to constantly be in front of your computer to track market movement, keep control of your losses, and lock in your profits.

Pending execution for Open Order and Close Order

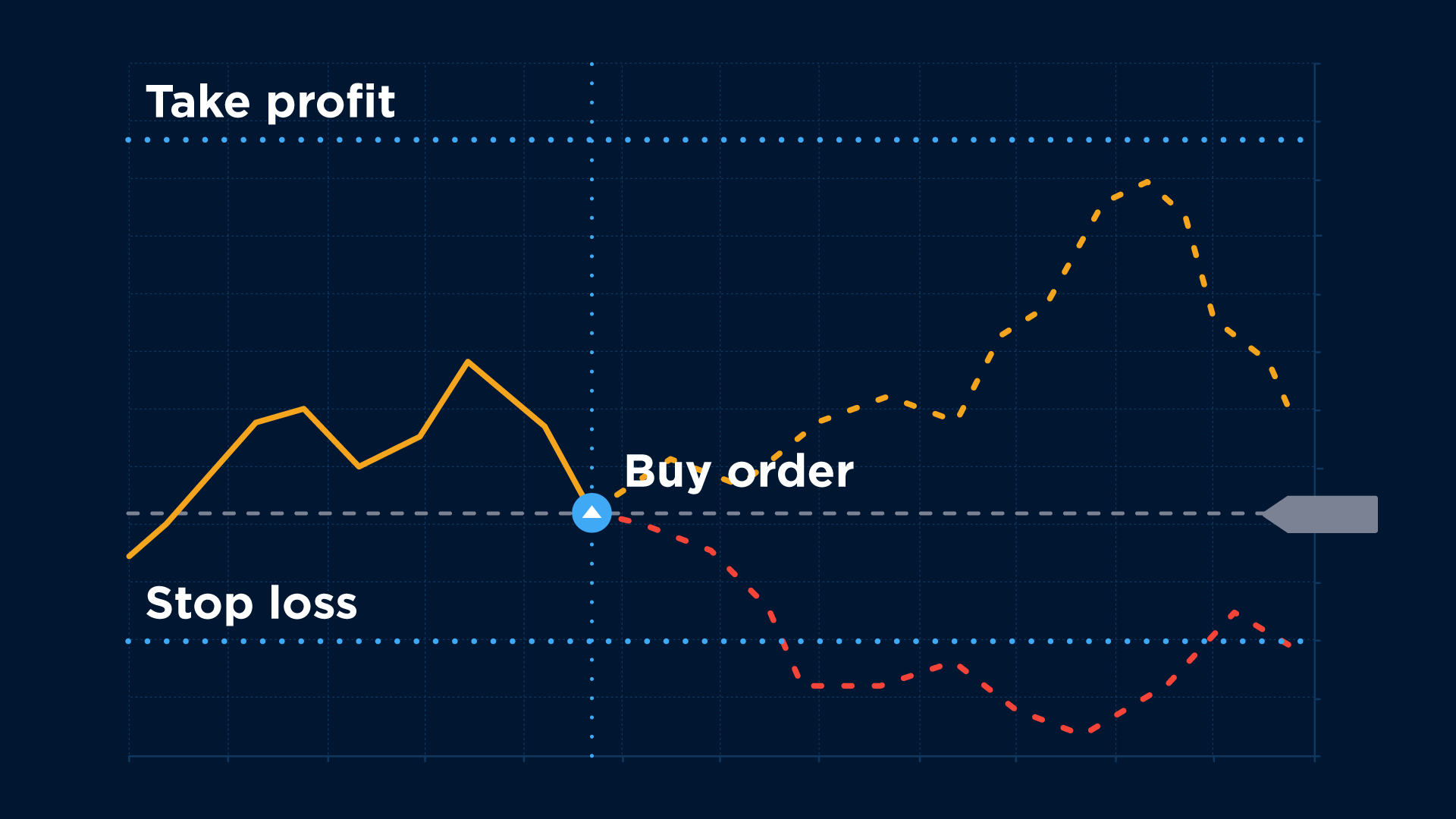

Every time you open an order via the MetaTrader platform, you can specify upper and lower price levels at which this order will be automatically closed. These thresholds are called ‘Take Profit’ and ‘Stop Loss’. We recommend you specify them both for every order.

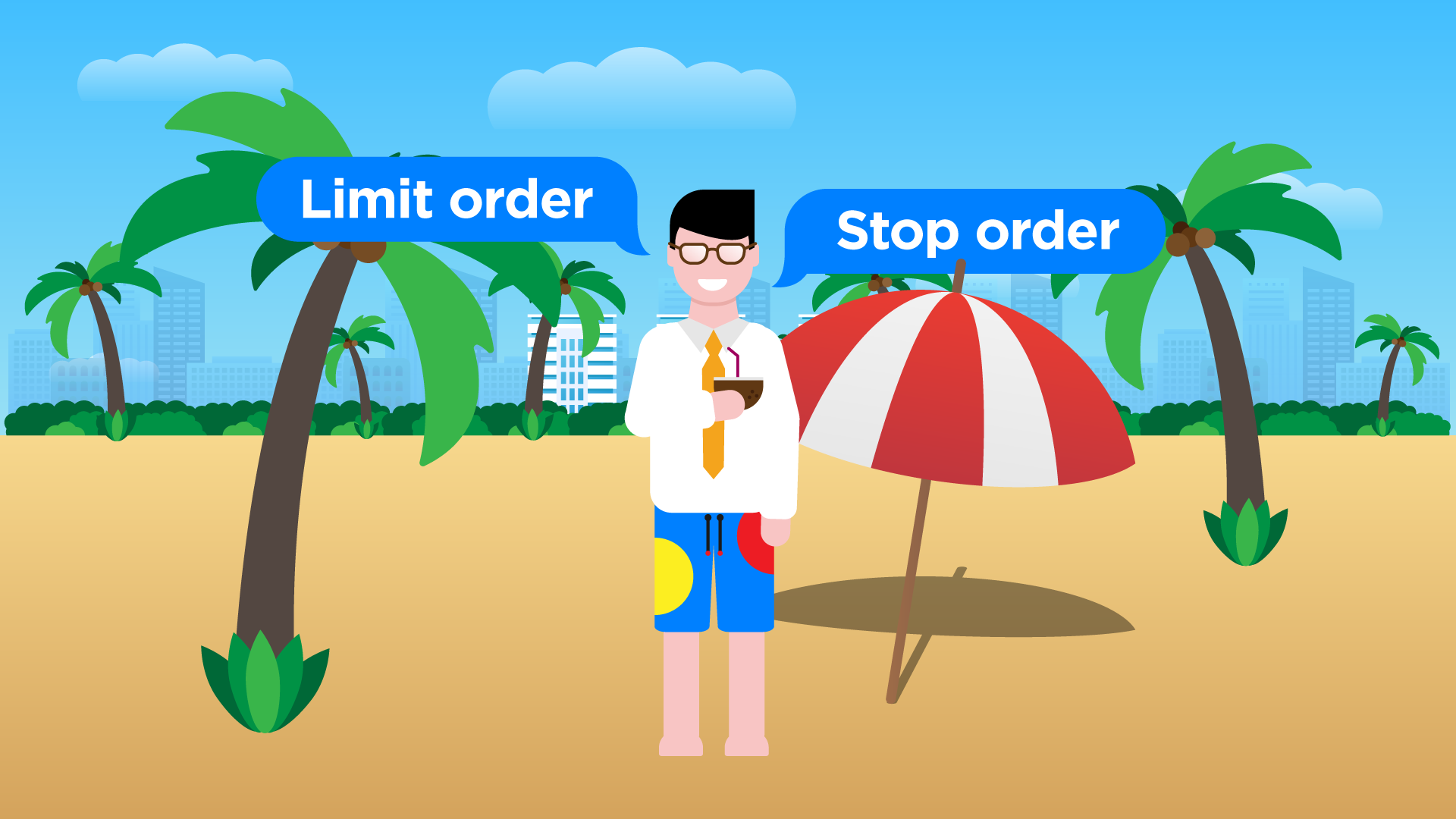

You can also create pending orders. These open automatically when the price hits the level you specified. These orders are called ‘Limit Order’ and ‘Stop Order’.

Take Profit and Stop Loss

Whenever you open an order, remember that you can always arrive at two possible outcomes:

1. Your prediction will be correct, and you will make a profit.

2. The market will go in the opposite direction, and your order will make a loss.

Stop Loss marks the maximum level of loss you can bear for the order, if the price goes against your prediction.

Take Profit marks the price level at which you agree to close your order and fix the profit.

Why do you need Stop Loss?

You may not have the MetaTrader charts in front of you at the moment the market starts moving against your forecast.

Stop Loss will help you keep the majority of your account balance.

Sometimes emotions may take over and you will be tempted to wait for the price trend to reverse, thus losing more and more money. Stop Loss will help you stay cool headed and close the losing trade.

This is where an important rule of successful trading comes into the picture:

Never move your Stop Loss level further from the price level of the order you’ve already opened.

Why do you need Take Profit?

The price often hits its maximum level quicker than you expect. Then it turns around, and you are too late to close the order at the most profitable price level.

Take Profit helps you close orders at the moment the price reaches the level you predicted.

If you have something more entertaining to do rather than gazing at the chart and waiting the priсe to reach the level you want, use Take Profit to switch off from MetaTrader.

How to set Stop Loss and Take Profit thresholds

If you open a buy order:

Set the Take Profit value above the opening price.

Set the Stop Loss value below the opening price.

If you open a sell order:

Set the Take Profit value below the opening price.

Set the Stop Loss value above the opening price.

The second important rule of successful trading:

Whenever you open an order, your expected profit should be three times bigger than your estimated loss. Remember the formula for profit that we introduced in the lesson ‘How to avoid paying extra to a broker’.

It follows that your Stop Loss level should be three times closer to the initial order price than your Take Profit level.

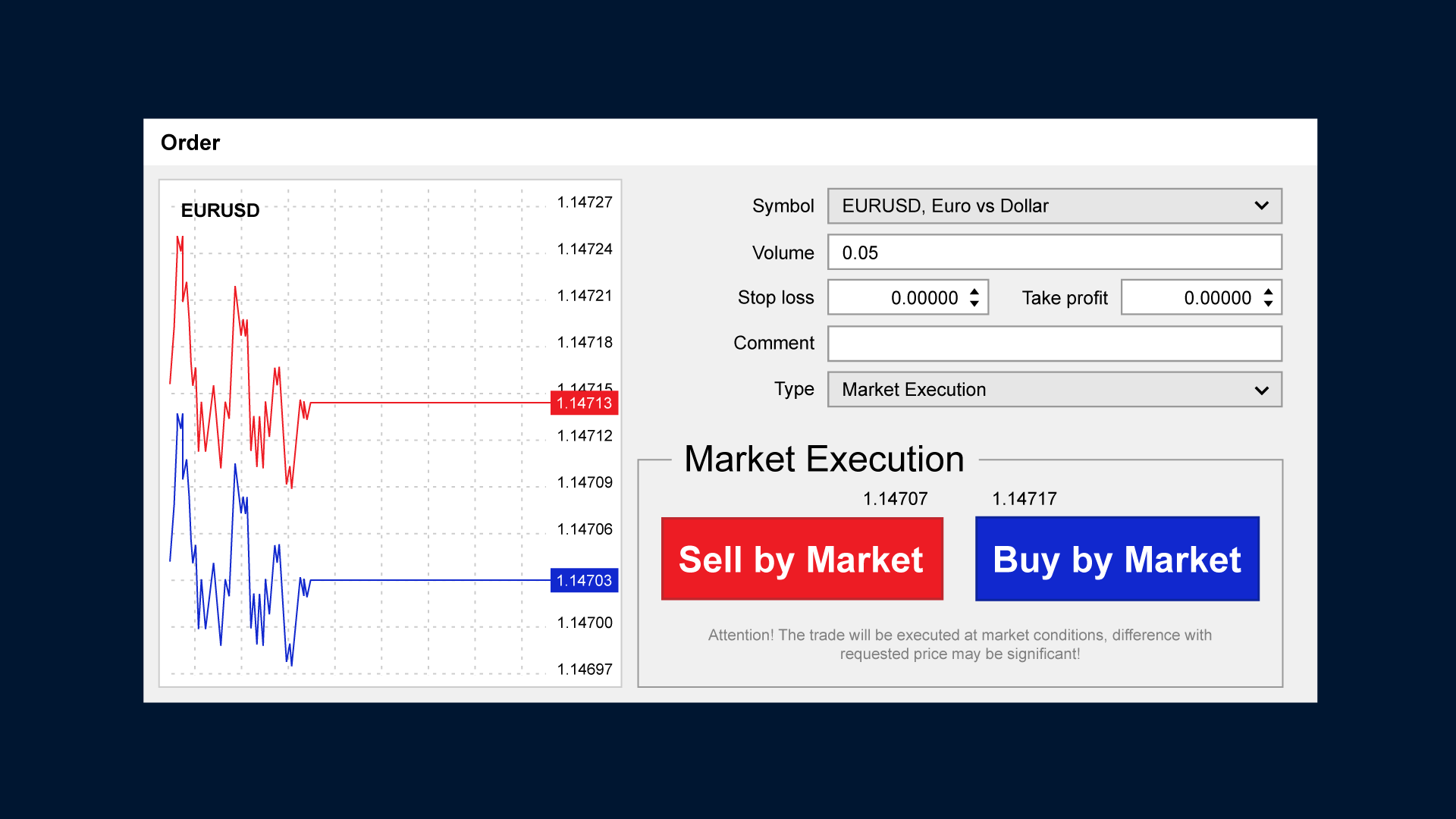

How to set Stop Loss and Take Profit in MetaTrader 4

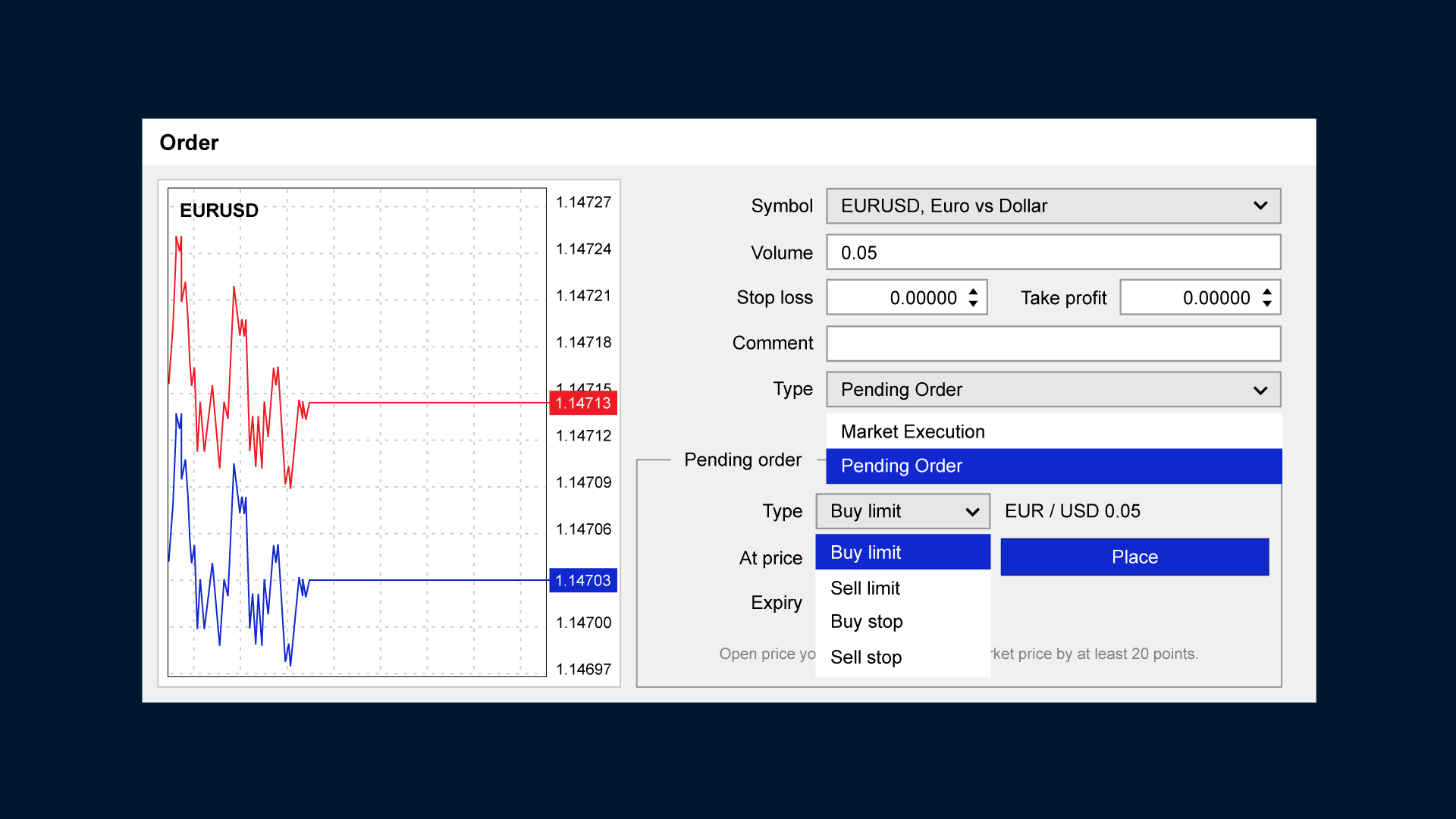

For desktop and web versions of MetaTrader 4:

Enter the price levels in the corresponding fields and confirm opening the order.

For the Android version of MetaTrader 4:

Enter the Stop Loss level in the field underlined with red and the Take Profit level in the field underlined with green.

For iOS version of MetaTrader 4:

Enter the Stop Loss and Take Profit levels in the fields with the corresponding labels.

Pending orders

There are two types of pending orders:

Limit Order

Stop Order

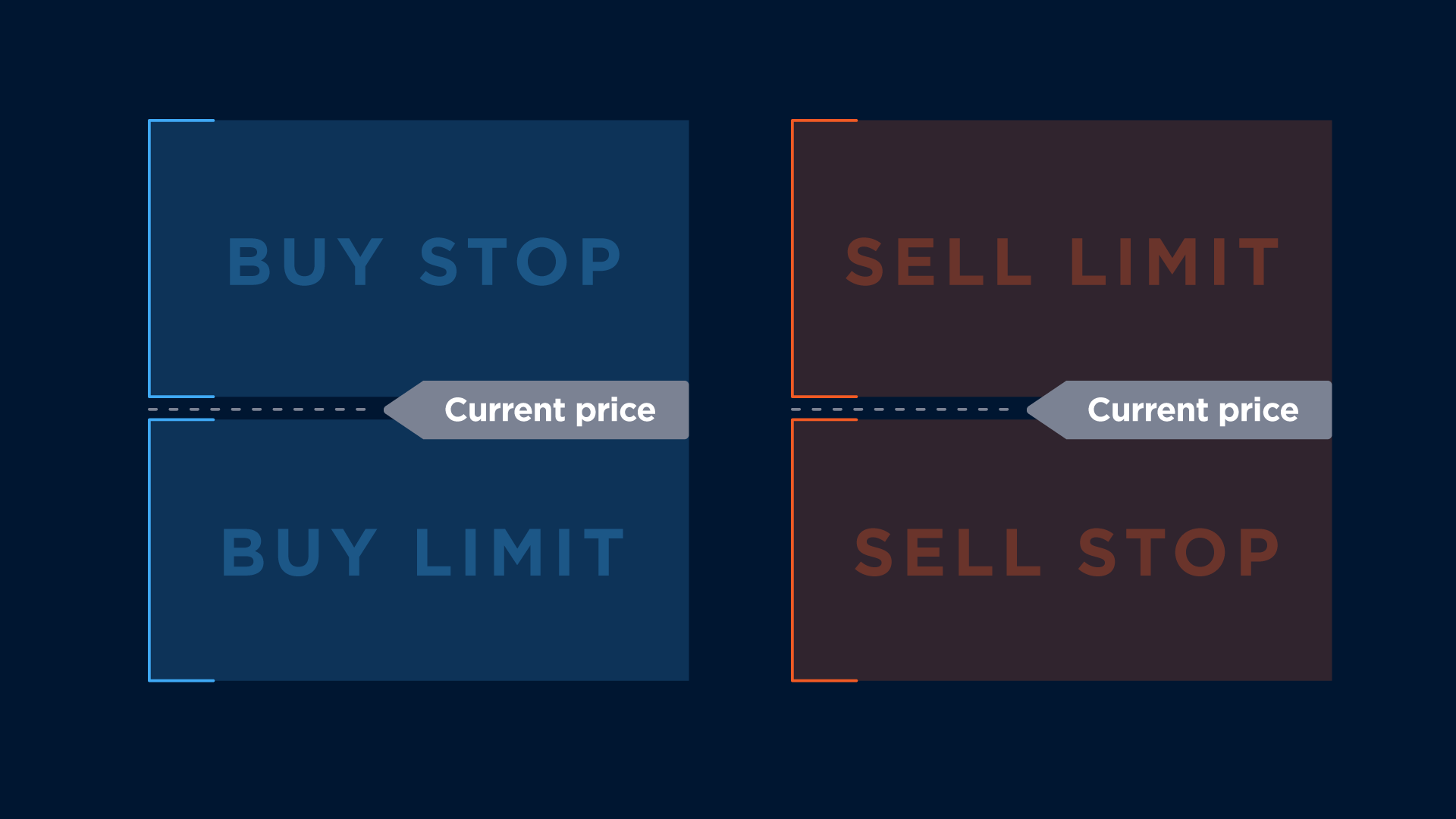

To open a pending Buy order, you need to do the following:

Open a Buy Stop Order if you want to set the price above the current price.

Open a Buy Limit Order if you want to set the price below the current price.

To open a pending Sell order, you need to do the following:

Open a Sell Stop Order if you want to set the price below the current price.

Open a Sell Limit Order if you want to set the price above the current price.

How you can use pending orders in trading

Limit Order

A price tends to reverse its direction after hitting its limit. Limit Order triggers at that point, allowing you to open an order at the most advantageous price automatically.

Stop Order

A Stop Order is applied when the price is about to surpass a specific level, at which point it is likely to start growing. Imagine that the ‘stop’ in Stop Order prompts you to stop waiting: when it triggers, we stop waiting and open an order.

Now let’s summarise what we’ve learned from this lesson:

-

You can open and close orders by market price. This kind of Forex trading requires you track the price in MetaTrader continuously.

-

Setting a Stop Loss limits your losses. It closes a loss-making orders at a predefined price. Stop Loss helps you stick to your initial strategy and protects your nerves in the case of uncertainty.

-

Take Profit allows you to get the most out of the deal. It closes your profitable orders at the set price.

-

If you want an order to open automatically at a certain price level, apply pending Limit and Stop Orders.

-

If you create a pending Sell order, apply a Sell Stop Order for the prices above the current price and a Sell Limit Order for the prices below the current price.

-

If you create a pending Buy order, apply a Buy Stop Order for the prices below the current price and a Buy Limit Order above the current price.